Designers, meet Credistry

If you’re a designer, you’ve come to the right place. First check out our Introduction to 179D presentation below (or download as PDF here), then read our FAQ’s, and fill out our short form to get started!

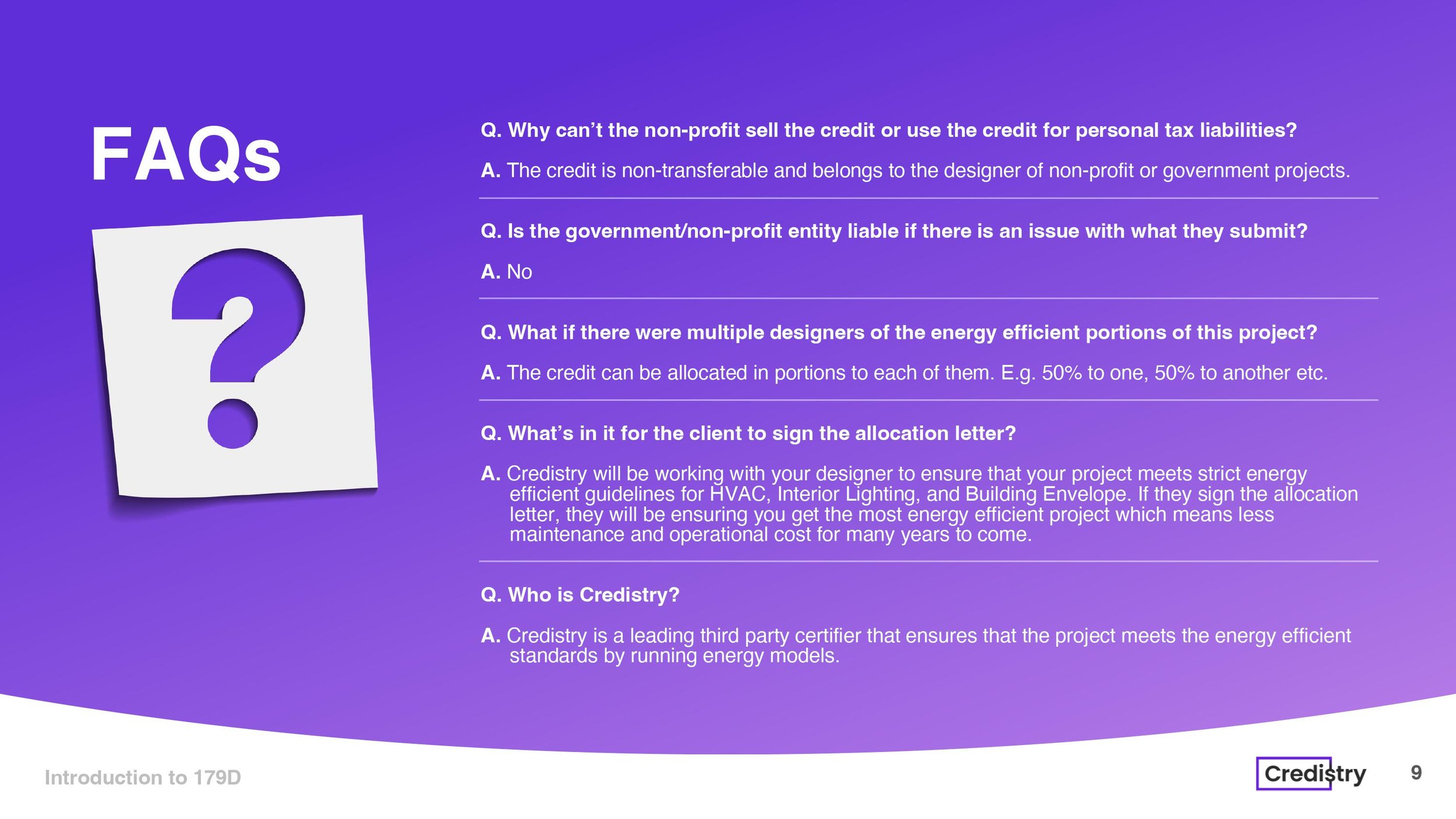

FAQs

-

The EPAct 179D Tax Deduction is a U.S. federal tax incentive that encourages energy-efficient building design. It allows building owners or designers to claim a deduction for the cost of energy-efficient improvements made to commercial buildings, such as lighting, HVAC, and building envelope systems. This deduction aims to promote energy conservation and reduce overall energy consumption in buildings.

-

Architects, engineers, and contractors that work on new or renovated government-owned buildings and structures. This includes things like schools, military bases, courthouses, prisons, hospitals, universities, libraries, parks, and airports.

-

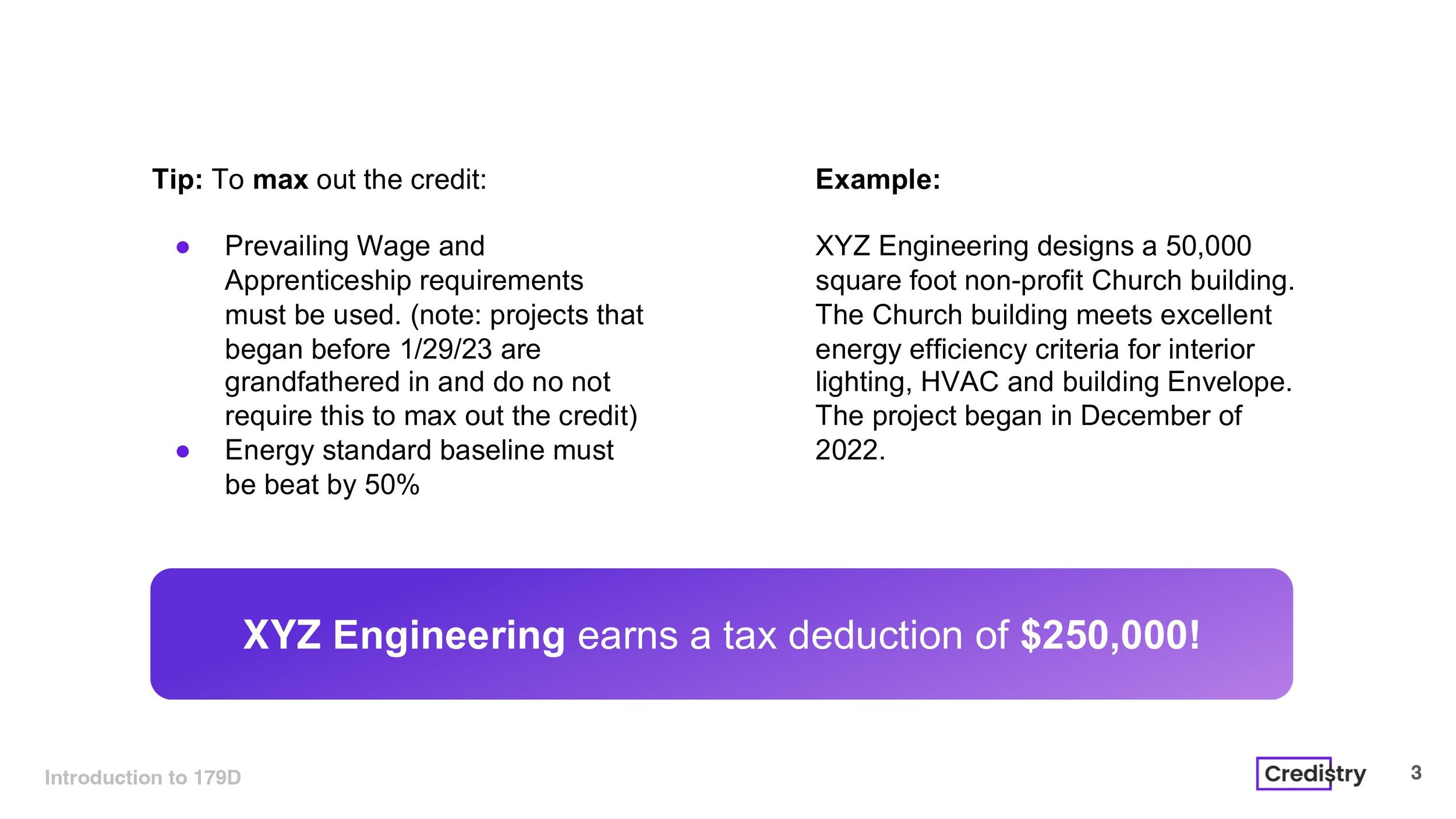

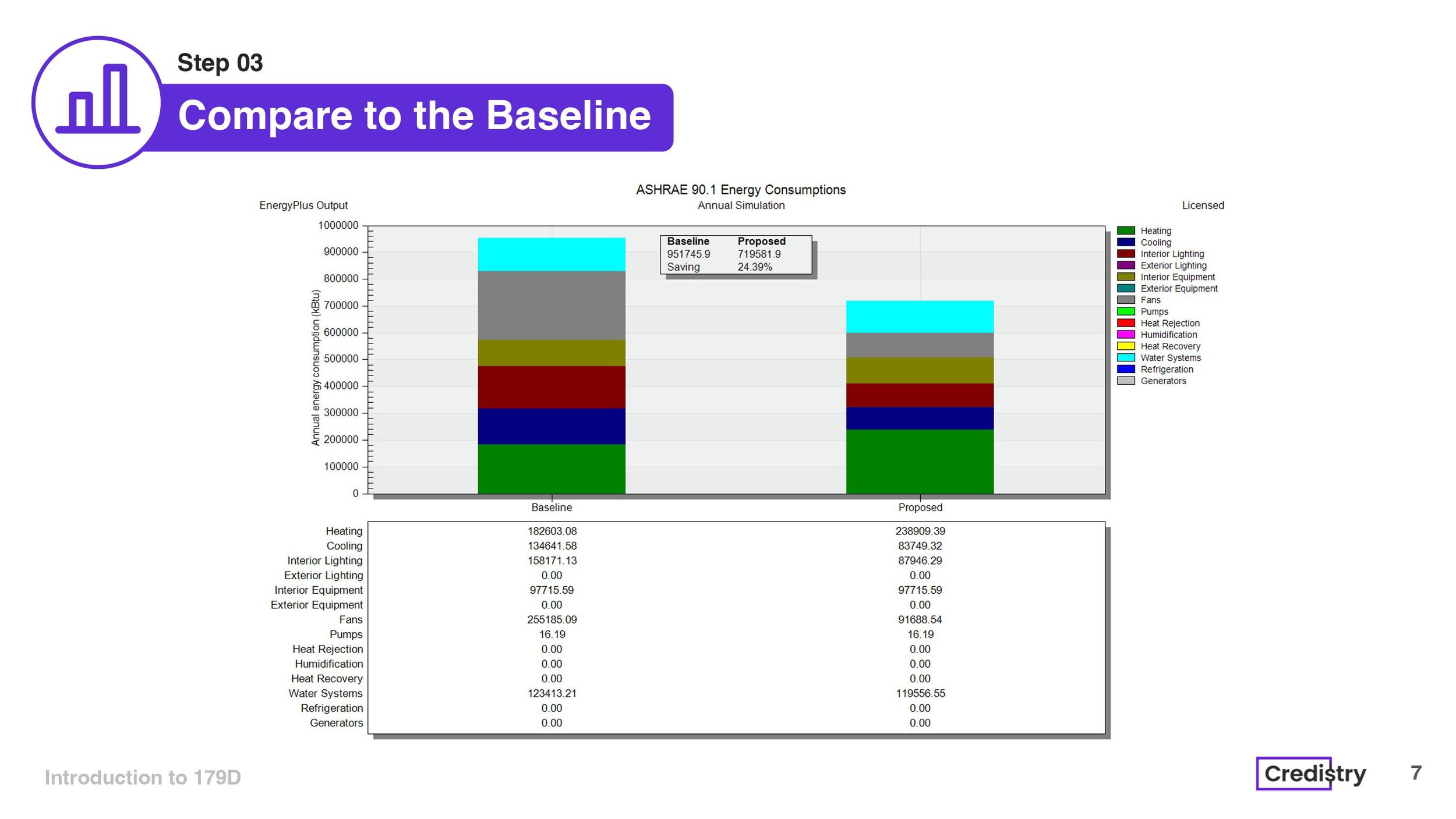

It depends on the specifics of each case, but it could be up to $5.00 per square feet of the building worked on. For example, if the qualified building is 100,000 square feet, that could mean up to a $500,000 tax deduction.

-

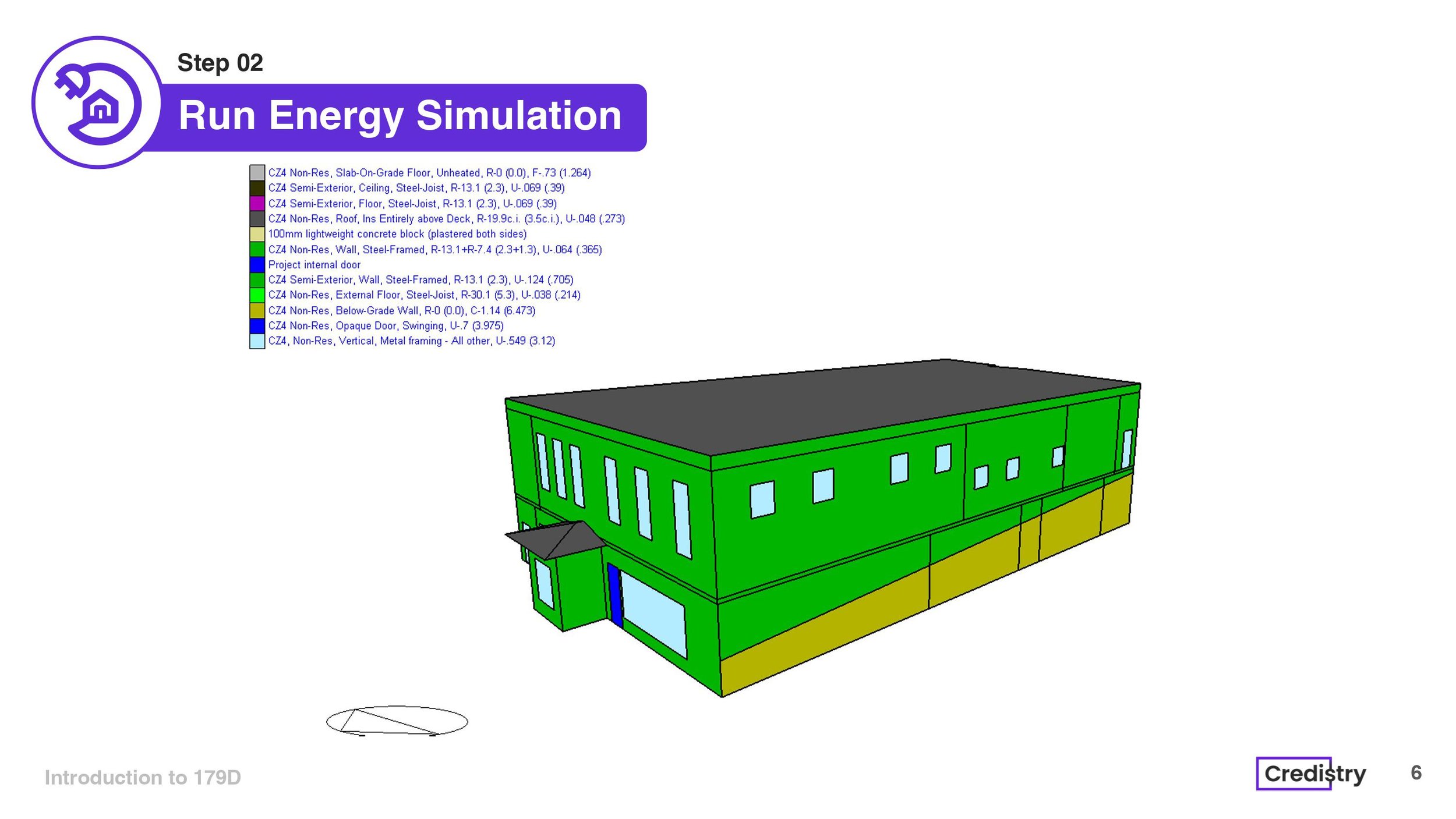

Eligible improvements for the 179D deduction include energy-efficient upgrades to lighting, HVAC (heating, ventilation, and air conditioning), and building envelope systems (like insulation and windows) in commercial buildings.

-

Eligible entities that can claim the 179D energy efficiency tax deduction include:

Federal, state, and local government agencies.

Public educational institutions, including schools and universities.

Public hospitals and healthcare facilities.

Nonprofit organizations.

Public housing authorities.

Tribal governments and entities.

Public transit systems and agencies.

Airport authorities.

Certain energy cooperatives.

Nonprofit organizations providing ambulance, emergency medical, and firefighting services.

Please note that the eligibility criteria and specific details may vary, so get in touch with us if you’d like to learn more.

-

Before 2023, architects, engineers, and design-build contractors could get rewards for energy-efficient projects they designed in government-owned buildings. But now, starting in 2023, they can also get rewards for their designs in certain tax-exempt places. This means more types of buildings can now join the energy-saving program!

Also, the Inflation Reduction Act made the program even better. Now, the reward is up to $5.00 per square foot.